March is National Credit Education Month. The Citizen Potawatomi Community Development Corporation guides CPN tribal members and employees at no cost as they build their credit, helping them to reduce interest rates, qualify for home loans and accomplish their financial goals.

While an individual’s credit score does not account for their entire financial portfolio, it affects their ability to obtain low interest rates on car loans, qualify for a home loan or fund business ventures. Many people know a high credit score helps, and a low credit score hurts, but not how to improve or manage one.

CPCDC Commercial Loan Officer and Certified Credit Counselor Felecia Freeman helps clients fill in these knowledge gaps.

“In high school, I didn’t learn anything about financial literacy,” she said. “This makes it difficult for people to know what they should be doing to build credit. Many people have had bad experiences — got burned, made decisions that weren’t advantageous — and stepped away thinking they couldn’t fix past financial mistakes. Fortunately, this isn’t the case. You can rebuild your credit fairly easy with a credit builder loan that the CDC has.”

Composition

Freeman pointed out most people’s credit score increases once they’ve learned about its components. The three main credit bureaus — Equifax, Experian and TransUnion — consider a few main conditions when calculating a credit score.

“All three bureaus use a little bit of a different algorithm or matrix, if you will. They utilize different percentages, but ultimately, it’s the same data that each credit bureau is looking for in determining your score,” Freeman said.

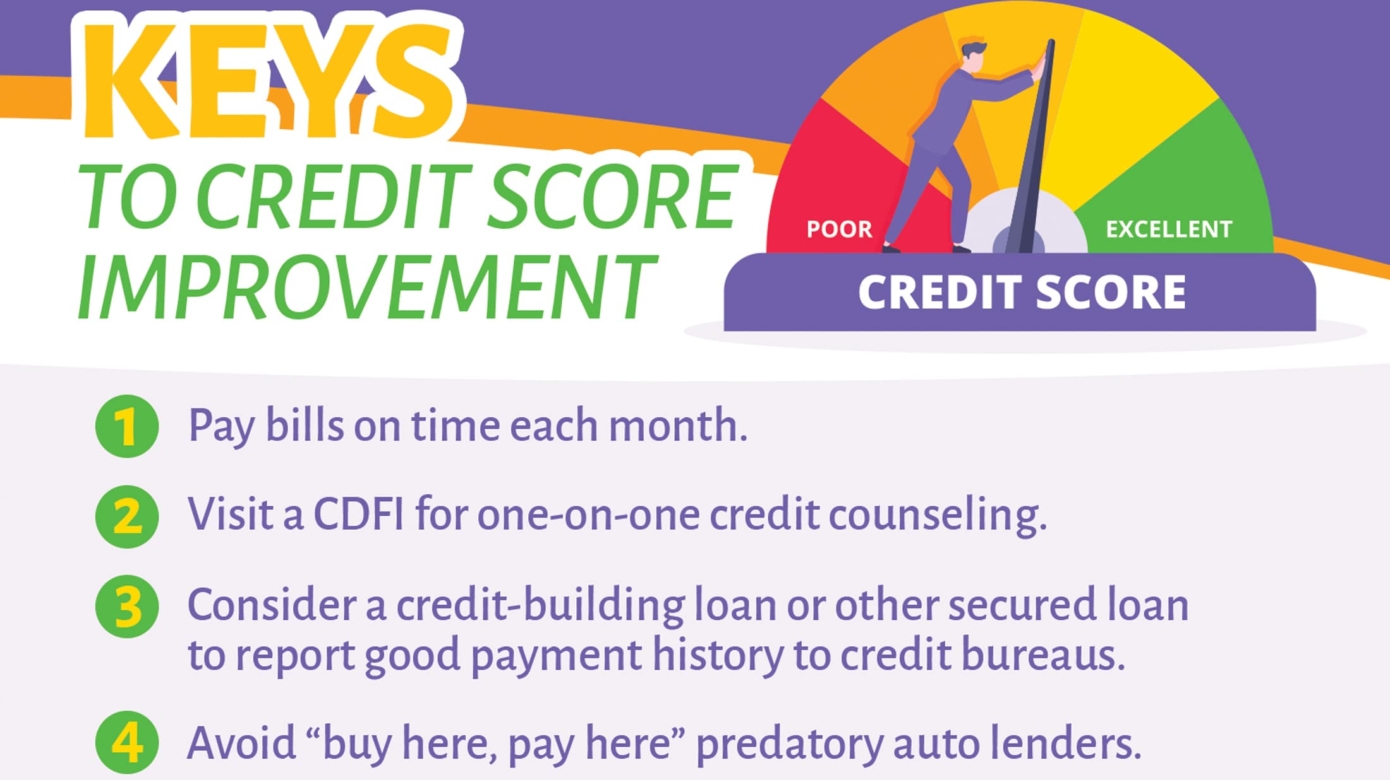

Paying bills on time remains the most effective means of raising and keeping a high credit score, counting for upwards of 35 percent of the algorithm.

Freeman educates her clients on how to look at it from the credit bureaus’ point of view. Together, they decide what areas need assistance and discuss manageable, straightforward ways to lift their financial portfolio.

CPN’s community development financial institution also helps clients with no credit score build one from scratch.

Services

“The most important aspect of building or rebuilding your credit is to get something good reporting monthly,” Freeman said.

She enjoys seeing the guidance and education turn into success. The CPCDC offers several tools and one-on-one services, including credit counseling, credit building loans, employee loans and commercial loans for business owners.

“Most credit unions and CDFIs have credit builder loans,” Freeman said. “But they are ‘pay-it-forward’ loans. It is a secured loan because we’re ensuring the loan payment with money you’re depositing every month into an account specifically for that payment, and we are reporting that good history to all three credit bureaus.”

Another factor to consider are auto loans.

“You need a car to get to and from work, but there were so many employees that were getting taken advantage of by predatory ‘buy here, pay here’ lenders, and that’s exactly why CPN and the CDC started the auto program,” Freeman said.

The CPCDC began the JumpStart Auto Loan program for CPN employees in 2010 to help alleviate those pressures, offer better loan terms and build credit from a car payment.

The CPCDC also assists CPN tribal members on the path toward homeownership. Freeman emphasizes that it is more attainable than many people think. She remembers helping someone take out a home loan after a divorce and a decade of renting as one of the most memorable success stories in her 15 years.

“They were in disbelief that they would qualify,” she said. “Never underestimate the power of good credit and how you can make it work for you.”

The CPCDC and Freeman also help Native American entrepreneurs fund their business ventures. Sometimes that means improving their credit in addition to counseling sessions with staff before applying for a loan. Whatever their needs, CPN’s CDFI has options.

The CPCDC offers tribal members and CPN employees the chance to take control of their finances. Find out more about the department and its offerings at cpcdc.org or Facebook @cpncdfi.