When one hears the term “Indian Land,” everyone thinks they know what that is. Yet the truth is that no one knows what it constitutes.

The phrase “Indian land” has no legal definition.

Trust land, restricted land, fee land, and allotted land are phrases that do have legal meaning and are described in general terms below.

- Trust Land is land whose deed reads “owned by the United State of America in trust for (tribe or individual).” The effect of this is that the land is only subject to the laws and regulations of the federal government. Sometime the trustee voluntarily submits to state or local laws and regulations to accomplish certain ends, such as to sell alcohol or tobacco. This ceding of power or authority may only be accomplished with the permission of the Federal government though. Land arrives in trust status via several different avenues including allotment of federally regulated lands such as Indian reservations. It can also be placed into trust at the request of the owner, which CPN does on a regular basis. Land can also be placed into trust via an act of Congress, which is usually initiated by the owner.

- Restricted Land is land whose deed reads “owned by (tribe or individual).” However the deed has a restriction such that the land may not be encumbered without the permission of the Secretary of Interior. This land is subject to some local, county and state authority.

- Fee lands’ deeds simply read, “owned by (tribe, individual or other legal entity).” This land is of course, subject to local, county, state and federal laws and regulations. Typically land the CPN purchases comes to us in fee.

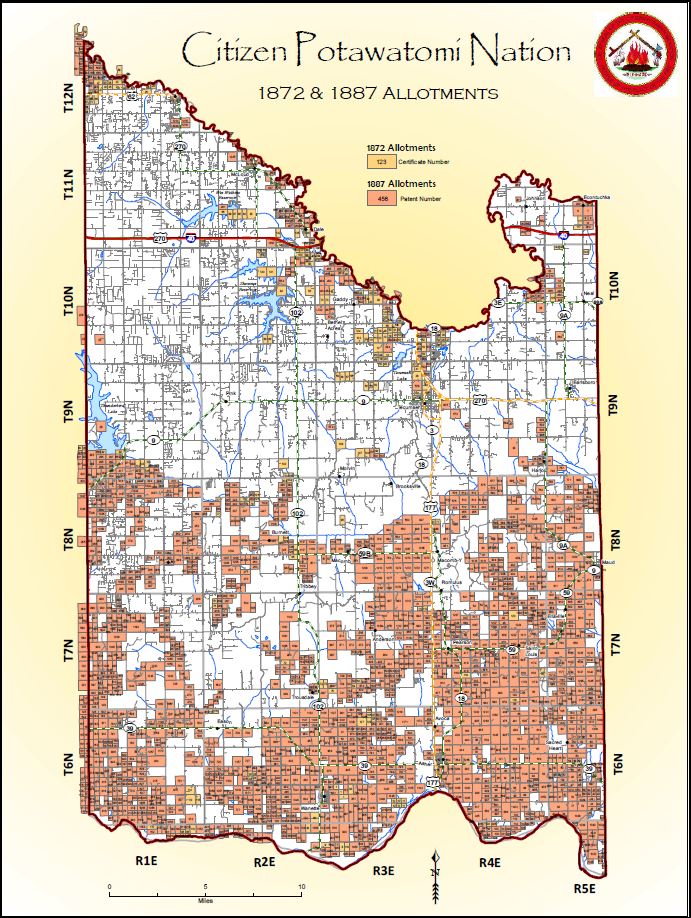

- Allotted land are trust lands that were allotted and given to tribal members at the time of the Dawes Act or in other acts that were enacted to dissolve tribal governments and open reservations to settlement by non-Indians. The acts assigned specific parcels of reservation land to individual tribal members, and the remaining reservation lands were taken by the federal government and opened for settlement. The “allotments” were retained as federal land and held in trust for the individual who was the named recipient of a specific parcel.

CPN owns land held in many legal forms including most of those listed above. The Tribe also owns land as follows:

- Fee Simple surface only.

- Fee Simple minerals only.

- Fee Simple surface and minerals.

- Trust land surface only.

- Trust land minerals only.

- Trust land surface and mineral.

- Undivided allotted interest, in fee surface only.

- Undivided allotted interest, in fee minerals only.

- Undivided allotted interest, in fee surface and minerals.

- Undivided allotted interest, in trust surface only.

- Undivided allotted interest, in trust minerals only.

- Undivided allotted interest, in trust surface and minerals.

The Tribal Department of Real Estate Services (DRES) keeps track of every square inch of that land.

An ongoing activity of DRES is to put fee land purchased by CPN into trust status. Placing property in trust for CPN has many great advantages. The most commonly cited advantage is the avoidance of state and local property taxes, and this is true. However, CPN frequently makes cash payments to local communities to replace tax revenues lost from the activities of CPN. In fact, avoidance of taxes is a minor plus to placing property into trust.

More significant reasons include: Tribal control is exerted of development policies and regulations.

- Taxes are collected, but are paid into the Tribal tax system rather than the state or local systems, which is a major source of income for CPN operations.

- Placing property into trust is an expression of Tribal sovereignty and a practical implementation of self-governance.

- It is a proven methodology of building wealth.

- Trust lands become the basis of long term enterprise development.

- It puts assets in a form that is difficult for shortsighted leadership to sell, destroy or misuse.

- It preserves land and wealth for future generations.

When asked how much land CPN owns, the standard response is 10,000 acres and it’s all “Indian Land.”

The Citizen Potawatomi Nation’s Department of Real Estate Services is located in the northwest corner of the second floor of the First National Bank Building, Suite 204. The staff is in their offices most of the time. However, the duties of several of the staff require them to be away from their desks. It is recommend that if you have business with any particular staff member, that you call to set up an appointment by calling (405) 395-0113.