In 2003, Citizen Potawatomi Nation founded the Citizen Potawatomi Community Development Corporation to help improve the financial literacy and economic opportunities of CPN tribal members and Natives in the community. April is National Financial Literacy Month.

CPCDC Director and CEO Cindy Logsdon said she and her experienced staff try to create the best experience possible for their clients.

“The very first thing that we focus on with clients with financial literacy is pointing out what they’re doing well before giving suggestions on what they could do better, because it’s sometimes a difficult subject,” she said.

They find their clients often need encouragement and direction while reassessing their financial values, goal planning, and implementing practical, everyday tips.

Values

The CPCDC helps clients reassess their financial values during individual meetings. Logsdon finds many parents rely on school to provide their children financial literacy, but according to her, learning about money and financial values from family members remains essential. She encourages clients to consider the knowledge they pass along.

“We do pick up so many of our habits from our parents and our views on money. Our relationship with money is so grounded in our influences, and that could be school, that could be parents, that could be media, peers. But we know that financial education is either given to you in the home or not, typically,” she said.

To increase financial literacy in the community, the CPCDC partners with other organizations for quarterly “lunch and learn” sessions that cover a variety of topics about banking and personal economics.

Planning

Goal setting, including short, intermediate and long-term goals, is an important part of financial literacy because it provides a plan. Logsdon assures her clients the CPCDC is a confidential and judgment-free resource.

“Maybe it’s just having somebody listen and just make suggestions or work out a strategy to get themselves out of the hole,” she said. “But I think the main thing here is, no judgment. We’ve all been there, done that and taken steps through different programs to make sure that we had a more secure financial future.”

Many times, clients’ goals include owning a home or starting a business, both of which require forethought. The CPCDC assists with finding outside resources as a first step to success.

“I would set myself up. ‘In five years, I want to be able to buy a home.’ Same with starting a business. … What does this look like? It’s almost like an ever-changing road map to know what the outcome is, and it’s not just here in my head because a lot of business owners, it’s just here in their head, and they never put it to paper,” Logsdon said.

In one-on-one counseling sessions, staff also show clients the basics of budgeting and saving. They provide information on free resources, including easy-to-use online tools. The CPN-owned Sovereign Bank (formerly First National Bank & Trust, Co.) also assists with housing and auto loans.

Tips

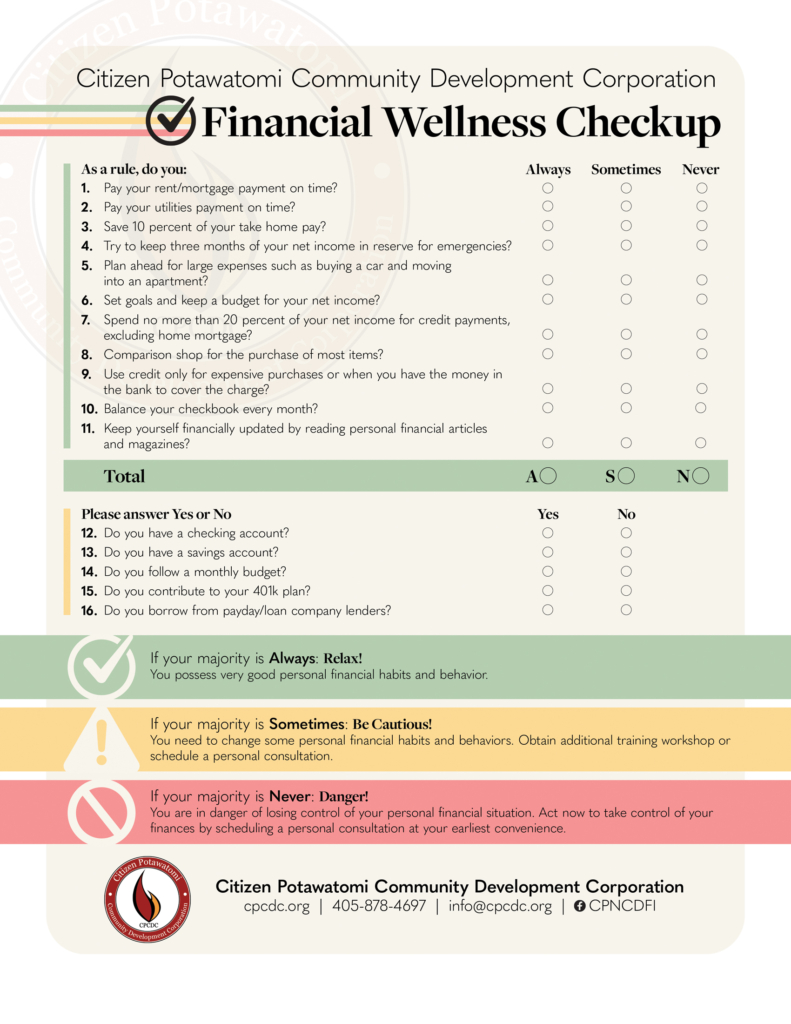

Generally, Logsdon recommends a more traditional “three bucket” approach to personal finances — spend, save and share. It includes placing 10 percent of total income in a savings account, donating 10 percent to a cause or organization, and using the rest for expenses.

“When you start saving, it starts a healthy habit. It creates that emergency savings. … We might suggest a look at a secondary job. ‘Is there a side hustle that you could bring in more money? Is there something that you could do to increase your income, or is there something that you could do to eliminate some of your expenses?’” Logsdon said.

The CPCDC staff steers clients away from payday lending, a predatory practice that offers cash advances on upcoming paychecks with interest rates between 150 and 650 percent, which makes breaking the borrowing cycle difficult.

“You could self-fund putting back a small amount of your paycheck and pay yourself first (instead). … And that should be built into a budget. You should always know where your money is going. And if you don’t know where your money’s going, that’s where you need to plug the spending leaks,” Logsdon said.

Clients sometimes avoid talking about their credit score as well, either because they have no previous history or stopped checking it. Education on how to approach and improve it makes them more comfortable.

“You should pull your credit from each bureau once a year, and you can rotate that into quarters to know what’s on there. And a lot of credit reports aren’t accurate, and the bureaus allow you to dispute anything that may not be accurate to better your score,” Logsdon said.

After creating a positive financial path, she always encourages clients to “keep the good going” for a stable future.

The Citizen Potawatomi Community Development Corporation counsels tribal members nationwide via phone or internet. To find out more, visit cpcdc.org or call 405-878-4697. Find the CPCDC on Facebook @CPNCDFI.