The last five years showed a rampant increase in internet fraud and data breaches, especially during the coronavirus pandemic. Americans filed a record number of complaints with the FBI’s Internet Crime Complaint Center (IC3) in 2021 — nearly 850,000. That is more than 2,300 complaints every day.

November 13 through 19 is International Fraud Awareness Week. In a recent interview with the Hownikan, First National Bank & Trust Co.’s Bank Secrecy Officer Greg Arbuckle said he saw an increase in online scams in the aftermath of the pandemic. Total losses in the United States rose from $3.5 billion to $6.9 billion between 2019 and 2021.

“People get up in the morning, and their job is to figure out different ways to scam you electronically,” he said. “And especially with the cryptocurrencies now and the prevalence of Bitcoin and Ethereum and so many of the other ones that are almost untraceable. It’s just so much easier for them to scam people out of their money.”

Popular scams

Phishing scams, personal data breaches and non-payment or non-delivery scams remain the types of fraud most reported by the public. “Puppy scams” became a prominent non-delivery scam while animal adoptions rose in 2020, a majority carried out through Facebook Marketplace.

“These fraudsters would reach out and say, ‘Hey, I have this dachshund or this really nice puppy, and all you need to do is pay me the fees for the vet bills. … Send me $2,000 or $3,000 to pay me the transportation and whatnot.’ Puppies never show up. The money is gone, and so is the fraudster,” Arbuckle said.

Victims also lost almost $1 billion in confidence fraud or romance scams, according to the IC3, which play on someone’s empathy, compassion or loneliness. Citizen Potawatomi Nation’s Adult Protective Services staff know elders are particularly susceptible to this type of fraud. Those age 60 and older comprised approximately one-third of victims of confidence/romance scams, according to a recent IC3 report.

“These scammers, they know that they’re lonely, and so they prey on them and normally succeed,” said APS Director Janet Draper. “Or they convince them that … their kid is in jail, and they need bail money, that type of thing.” This is also known as the “Grandparent Scam.”

However, the fraud Arbuckle sees reaches beyond the screen. He encounters solicitations and opportunities clients receive by mail. Arbuckle recommends that everyone look out for fraudulent checks, cashier’s checks or anyone requesting money orders or electronic funds transfers.

“I think that’s what I see an awful lot of is people get these solicitations in the mail to say, ‘You’ve won this.’ Or ‘This is going to happen. And here’s a check. You need to just deposit this and wire me back X amount of dollars, and you keep the rest,’” Arbuckle said, recalling a customer brought a fraudulent check to the bank earlier that morning.

Prevention tips

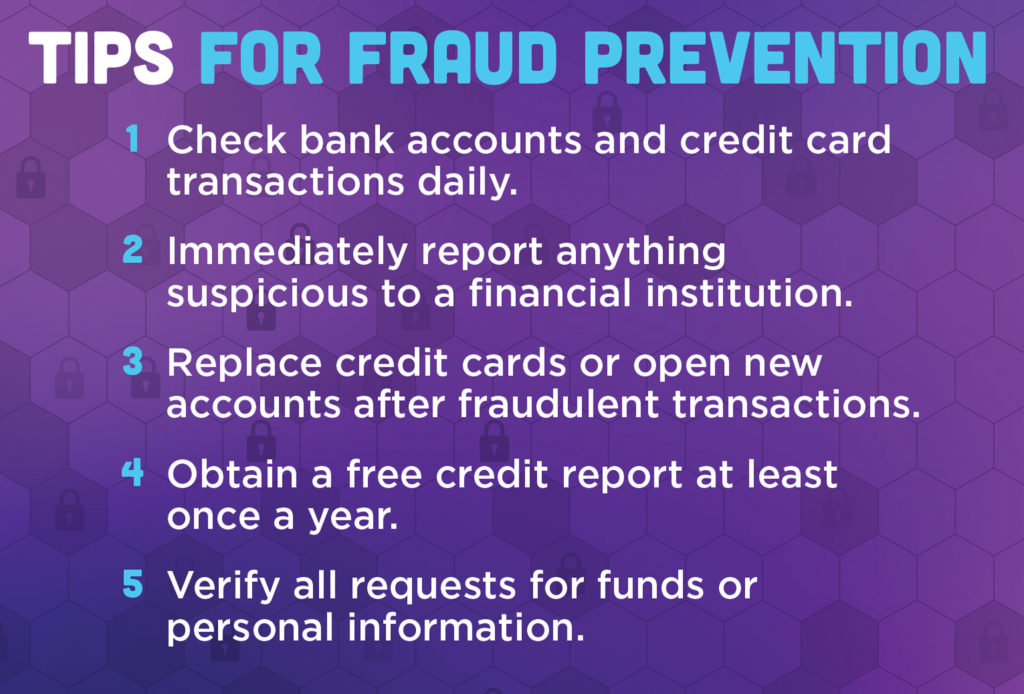

Arbuckle encourages everyone to check their bank accounts and credit card transactions every day. Many banking smartphone apps allow customers to receive notifications per transaction. However, many people tend to ignore their accounts.

“They don’t look at their bank statements. They don’t look at their credit card statements. They don’t log online to look at their account. I would just encourage everybody to do that as much as possible. Do that on a daily basis, if you have the time to do that,” he said.

Customers should report anything remotely suspicious to their financial institution as soon as possible. Sometimes that involves getting a new credit card or opening a new account.

“I would 100 percent say if you suspect something, just close it, and get another one. It’s not that hard. It might put you out for a day or two or maybe a week, but usually not longer than that. And what’s a week when it’ll save you thousands of dollars potentially?” Arbuckle said.

Swift action can make the difference in resolving the issue with no loss.

“It’s just like anything else. You need to be diligent about that and report it as quick as you can because there are timeframes involved in a lot of that stuff,” he said.

Annual credit reports also help prevent any long-term identity theft.

Adult Protective Services Case Manager Brian Moore encourages clients to follow their instincts and remember that if something seems too good to be true, it probably is.

Many elders also fall victim to fraud on the phone.

“If you think it’s a scam or you’re not sure, actually hang up and just actually call. Like if it’s Medicaid, call the Social Security Administration, say, ‘Hey, this is what I was told.’ Don’t make any decisions, don’t give any information out, and call and see if that’s a verified number,” he said.

Most importantly, never give out Social Security numbers, routing numbers or any banking information to unverified sources.

“If you’ve just got an inkling that it’s something’s wrong or it doesn’t feel right, doesn’t sound right, then stop and make contact with somebody that you do trust,” Draper said.

Find more information about fraud, visit the First National Bank & Trust Co. website at fnbokla.bank. Reach the Citizen Potawatomi Nation Adult Protective Services Department at 405-878-4831.