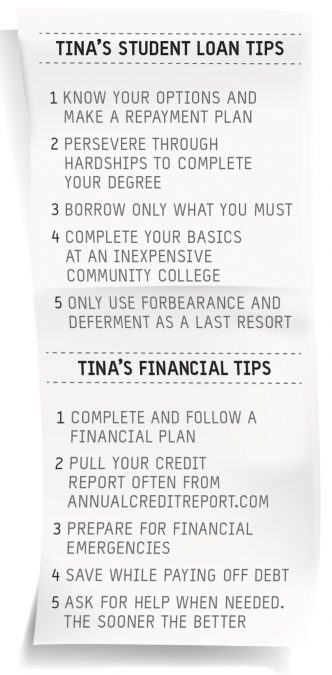

Student loan debt grows each year. In fact, it’s increased almost 150 percent over the past decade. For some, student loan debt cripples finances and stresses their budgets. However, help is within reach. Citizen Potawatomi Community Development Corporation Consumer Lending Coordinator Tina Pollard recently became a certified student loan counselor, which expands her ability to provide financial advice to CPN members and employees.

“When I started my career here, I became a certified credit counselor and started seeing people for financial counseling. I quickly found a lot of my clients had problems with student loans,” Pollard said.

Getting out of student loan debt takes time and self-discipline, and untimely payments result in significant repercussions.

“I do see clients that have defaulted on their student loans. Then we get them into the income-based repayment plan, and their payments are zero,” Pollard said. “However, they’ve now defaulted, and they’ve reduced their credit scores. Depending upon how many student loans (an individual has), that’s how many times it’s counted against you.”

Failure to make payments may cause wage and tax return garnishments as well as prevent future credit opportunities.

“Lenders tend to take that very seriously because it does show a pattern,” she said.

Reaching out to a certified student loan counselor can help borrowers navigate the complexities of student loans.

“Probably the biggest barrier I see is people are afraid to talk to their lenders,” Pollard said. “What they don’t know about student loan companies can really hurt them financially because there are lots of programs to work with them, but if they don’t call, opportunity is lost.”

Forming a plan

She stays up-to-date on regulations and researches potential solutions to determine which programs are most advantageous for each client.

Managing student loans “is kind of like Tetris, but you have to know the rules,” she said. “If you don’t know the rules, you’re going to lose the game.

“You have to be strategic, so sometimes it’s not best to consolidate all of your loans if you’re not settled into a career because you can only do it one time,” Pollard added.

Clients employed by governmental entities, including tribal, or nonprofit organizations may be eligible to receive Public Service Loan Forgiveness Program assistance.

According to the U.S. Department of Education, “The PSLF Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.”

Since tribal government employees meet eligibility, many employees across CPN could receive assistance through the PSLF Program. However, several previsions exist. Only direct loans qualify, the student must make 10 years of timely payments and the borrower’s employer has to submit periodic certification forms, which Pollard recommends updating annually.

“This program may or may not continue with the new administration’s proposal. If you believe you are eligible, I would recommend applying now,” Pollard said.

Many of Pollard’s clients receive phone calls from loan companies attempting to privatize their student loans.

“When that happens, all of the public benefits go with it,” she added. While privatizing federal student loans sometimes decrease interest rates, it is important to know the full scope of the potential consequences before committing.

“If you’re a low-income borrower, and it doesn’t have to be all that low, sometimes an income based repayment plan would be best,” Pollard said. Income based repayment plans may provide student loan forgiveness opportunities.

While some may believe more money will equal more financial stability, without sound goals and a plan, more money could actually equal more debt.

“You’re literally only as financially secure as your savings account tells you,” Pollard said.

Her passion is finding solutions that lift CPN members and employees out of debt, but clients must be open and honest with her to receive the best assistance for their situation.

“They can expect that the information they share with me will not go any farther. Confidentiality is incredibly important,” she said.

Pollard not only serves clients as a certified credit counselor and student loan counselor, but she is also a certified career and financial coach. Her main objective is to help others become more financially secure overall.

“I help people find jobs and with resume writing, and then coaching them, because career and finances come together. If you can’t find that perfect match that pays you well enough to pay for everything, then that makes it hard,” she said.

Since most potential employers pull credit checks on applicants, less than optimal credit scores create additional obstacles.

“We help them and coach them on how to advance their careers while at the same time, we’re helping them get their house in order,” Pollard explained.

Call 405-878-4697 to learn more about the CPCDC’s financial counseling services, including student loan counseling.