The Citizen Potawatomi Community Development Corporation was one of seven community development financial institutions to close on a multi-party bond totaling $127 million. On its own, the CPCDC has secured a $16 million bond as part of the United States Treasury Department’s CDFI Bond Guarantee Program. With this bond, the total amount of financing secured for 2015 is more than $21.3 million, exceeding the combined total for years 2003-2014.

“We are excited to have secured this bond and to have increased our funding during 2015,” said Citizen Potawatomi Community Development Corporation Director Shane Jett. “We’re the only Native American CDFI participating in this bond program setting an important precedence for the 70 other Native CDFI’s around the United States.”

This bond is part of a landmark round with $327 million in bonds issued, marking the third year of the program designed to provide CDFIs with the long-term, reliable capital they need to spur development in low-income and under-resourced communities. Opportunity Finance Network was the qualified issuer.

“OFN is proud to have issued this multi-party bond for our member CDFIs to catalyze critical economic development in underserved areas throughout our country. This bond is a testament to the financial strength of our member CDFIs, and a reflection of their effectiveness in providing access to responsible and affordable capital where it is needed most,” said OFN Chief Operating Officer Cathy Dolan. “Through this $127 million, multi-party bond, OFN members like Citizen Potawatomi Community Development Corporation can reach further into tough markets to make a real difference.”

Other participants in the multi-party bond include:

- Chicago Community Loan Fund (Chicago), $28 million

- New Jersey Community Capital, (New Brunswick, NJ) $28 million

- Bridgeway Capital (Pittsburgh, PA), $15 million

- Community Ventures (Lexington, KY), $15 million

- FAHE (Berea, KY), $15 million

- Kentucky Highlands (London, KY), $10 million

Enacted as part of the Small Business Jobs Act, the CDFI Bond Guarantee Program is an innovative federal credit program designed to function at zero cost to taxpayers.

It provides eligible CDFIs access to long-term, fixed rate, affordable capital to encourage economic growth and development.

“The CPCDC is unique in the sense that we lend to Native American-owned firms and communities that would otherwise lack access to capital,” said Jett. “We, along with our fellow OFN organizations, have shown we are capable and responsible lenders, and this latest bond will be used to further our mission of promoting small businesses creation and expansion.”

On November 10, the CPCDC will also receive a $100,000 Next Seed Capital Award from the OFN’s Wells Fargo Next Awards for Opportunity Finance. The award will go to further the CPCDC’s efforts to eradicate predatory lending in Native American communities in Oklahoma and across the CPN. The CPCDC will use the Next Seed Capital Award funds to expand its employee loan program, available to Tribal employees as well as launch home improvement and storm shelter construction loan programs.

The Wells Fargo NEXT Awards for Opportunity Finance distribute nearly $6 million in funds to organizations who cater to the more than 25 percent of American households forced to use high-cost financial products and services due to lack of responsible lenders.

“At Prudential, we’ve always been dedicated to helping people build long term financial security, and our support for the NEXT Awards is an expression of that commitment,” said Lata Reddy, vice president, Corporate Social Responsibility, Prudential Financial, Inc. “We’re proud to invest in the winning CDFIs and applaud their efforts to expand access to critical, affordable financial products and services in underserved communities. These organizations are helping create new pathways to prosperity where they are needed the most.”

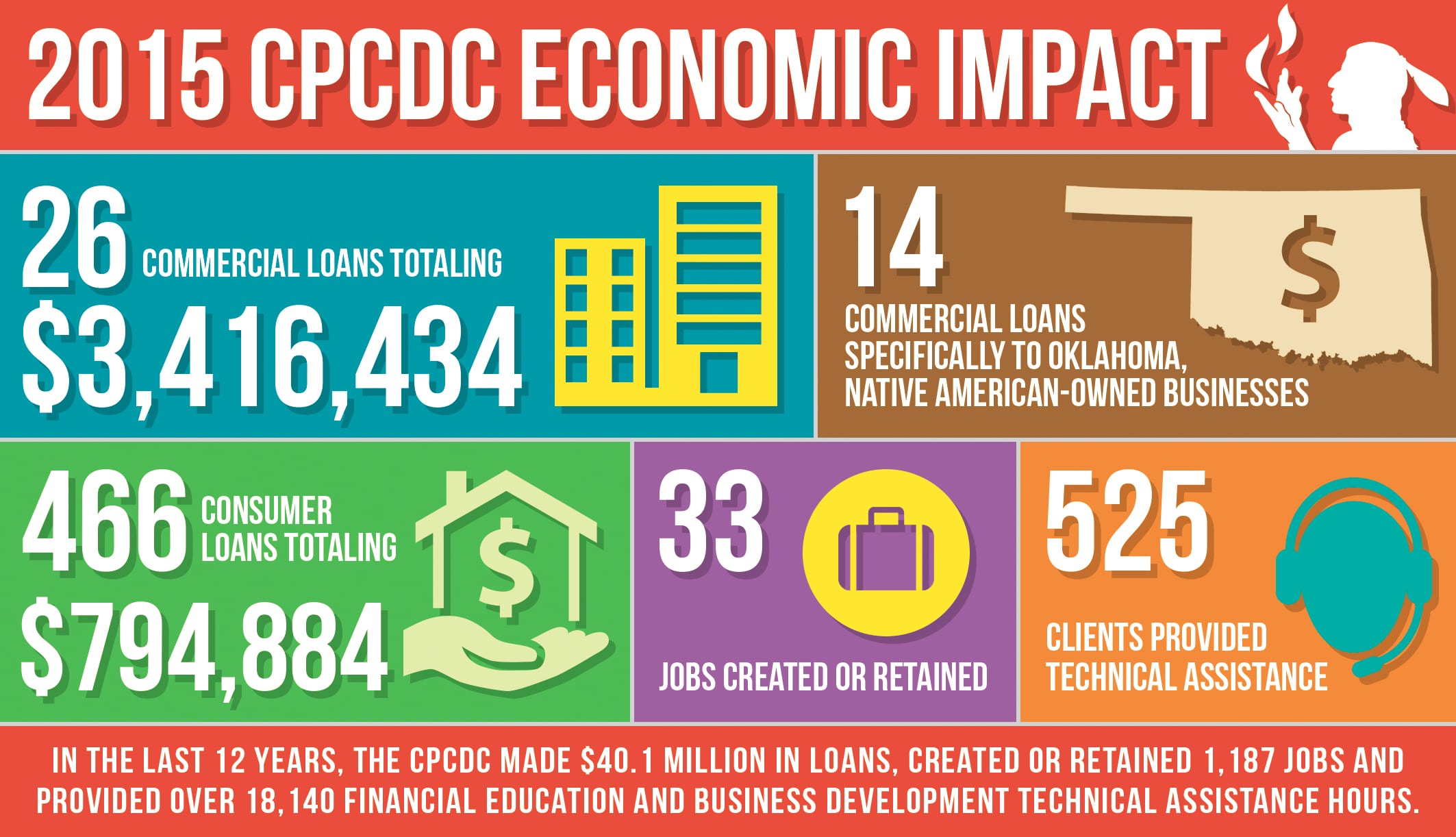

Established in 2003, the Citizen Potawatomi Community Development Corporation provides financial products and counseling services to the Citizen Potawatomi Nation members and employees nationwide as well as Native American-owned businesses throughout Oklahoma.